What if owning a piece of a masterpiece wasn’t just for the wealthy elite? In the world of NFTs, high-value assets are gaining speedy popularity. The Merge, by NFT artist PAK, shattered records when it sold for $91.8 million a few years ago. Other high-profile sales like Everyday: The First 5000 Days, Clock, HUMAN ONE, and CryptoPunks have also sold for millions in the past.

While this is a testament to NFT’s potential, it’s also a barrier to entry for most enthusiasts. How many collectors can afford to spend millions on a single NFT? The answer is NOT many. Often, owners of valuable NFTs find it difficult to sell them. Fractionalized NFTs could be a way to solve this problem.

Key takeaways:

- Fractionalising is the process of splitting an NFT into several individual tokens.

- Fractional NFTs allow many collectors to own a small part of a larger NFT.

- The most common is the Ethereum blockchain, where a single ERC-721 token is turned into several ERC-20 tokens

- The legality of Fractional NFTs varies wildly between jurisdictions

What Are Fractionalized NFTs?

Fractionalized NFTs are among the latest innovations in the blockchain world, where a single Non-fungible token can be divided into smaller, tradeable pieces. In simple terms, Fractional NFTs are ‘shares of a single NFT.’

NFTs are digital assets functioning as digital certificates of ownership of assets. The most fundamental feature of NFTs is the Non-fungibility attribute. This, in essence, means that an NFT cannot be replaced or replicated—there cannot exist two NFTs with the same qualities.

Another attribute of a non-fungible token is indivisibility. This means that an NFT cannot be divided into smaller chunks. Now, this brings a problem!

Some NFTs have extremely high value, sometimes spanning $10s of millions depending on rarity. For instance, The Merge and NFT by PAK stands among the most expensive NFTs ever sold, fetching $91.8 million in December 2021.

It is sometimes difficult for NFT enthusiasts to fully own these hugely expensive yet indivisible assets. That’s why the concept of fractionalized NFTs came to life.

When fractionalizing an NFT, the creator breaks it down to thousands, perhaps tens of thousands, of easily purchasable pieces on the marketplace. This inherently means that even small investors can hold a share of an otherwise indivisible digital asset

The concept is akin to owning shares in a company. Instead of purchasing the entire asset, individuals can own a fraction of it, thus making high-value NFTs more accessible.

How Do Fractionalized NFTs Work?

As already mentioned above, NFTs are inherently indivisible. So, how do fractional NFT creators develop these highly divisible Non-fungible tokens?

The process is quite simple:

- The high-value, non-fungible token must be locked in a highly reliable smart contract. By locking it, the creator can never withdraw the token, with the full approval of the smart contract.

- The smart contract then issues fungible tokens in the form of ERC-20. Each token represents a fraction of ownership in the NFT. Interestingly, these tokens are fungible, meaning they can be directly exchanged for each other. As such, These fractional tokens can be freely traded, bought, or sold on decentralized exchanges or NFT marketplaces.

A good example is an NFT worth $10 million. Purchasing this NFT as a unit in full will be a problem for many. But what if the NFT is fractionalized into 10 thousand tokens, each worth a mere $1000?

Essentially, an investor owns only 0.1% of the NFT by buying an individual token. This means the investor shares 0.1% of the profits and losses associated with this NFT they own.

The NFT fractionalization mechanism, in essence, opens the NFT space to a bigger audience. It essentially lowers the entry barriers for high-value assets.

The fractionalized NFTs come with attributes like accessibility, liquidity, and community ownership.

Criteria for Selecting a Good Fractionalized NFT

You are probably now interested in exploring the world of fractionalized non-fungible tokens but don’t know how to begin. The big question for investors is how to select a good fractionalized non-fungible token.

Here are a few primary considerations:

- Consider the innovation and uniqueness of the NFT — Is this NFT a copy of another? How unique is it? What is the story behind it? How innovative is it? Those are some questions that must be answered.

- The popularity and market demand of the NFT — Popular NFTs can attract a wide market and are hence capable of gaining more value.

- Utility and benefits for fractional owners— An NFT with many benefits and utilities, especially for fractional owners, is one to go for

Top Fractionalized NFT Projects

WEN Price

Positioned at 798 based on Coingecko’s ranking (with a 55 mil. market cap), WEN defines itself as a cute cat on a mission. WEN builds a community around a fraction of NFT-based coins.

The fractional NFT is completely based on a poem called A Love Letter to Wen Bros, written by Meow, a pseudonymous creator. This Solana-based NFT has been broken into 1 trillion small pieces, and hence, it can trade on Solana-focused decentralized exchanges. Each token represents a small fraction of ownership of the WEN NFT.

The idea behind WEN’s creation is to promote positivity within the cryptocurrency community. Moreover, the coin intends to help support Jupiter Exchange and Solana blockchain.

Own The Doge

Ranking 874 based Coinmarketcap, Own The Doge, ticker symbol DOG is the second largest fractionalized NFT in the crypto space. This token is inspired by a rare photo 1/1 original piece of a dog named Kabosu by Atsuko Sato. The photo was sold as an NFT to PleasrDAO for 1696 ETH, roughly $5.5 million at the time of sale.

Later, PleasrDAO fractionalized the NFT into billions of fungible tokens, allowing everyone to purchase the tokens easily. The NFT was sold to individuals each for a sub-dollar value, meaning investors, even with as low as $1, could actually own a share in this NFT.

Owing to the slowed growth of NFT, DOG tokens trade at a mere $0.00348 in 2025. However, investors can still own large chunks of this NFT. The market cap of DOG now stands at $47 million.

Own The Doge intends to give back to the community through charities. According to its website, since the project’s inception, Own the Doge has donated over $2 million to charities.

YES

One of the most recent fractionalized NFT projects is YES, which was launched a year before this write-up was created.

Another groundbreaking innovation in the world of fractional NFTs is the YES token. Describing itself as a Meme fungible token, YES combines the strengths of memecoins (ERC-20) and NFT (ERC-1155). It is a project readily inspired by the Yes Chad Meme.

According to the web page, about 100,000 YES coins have been minted, with each individual YES representing a bridge to an NFT.

When this report was written, YES’s unit price was above $4.6, and its market cap was below $1 million.

Unicly

This project is unlike the above-mentioned, which are fractionalized NFTs by themselves. Unicly is, in essence, a marketplace where investors can purchase fractionalized NFTs.

As a newcomer in digital assets, Unicly allows users to lock a collection of NFTs and share a token named uTokens. Every token is a fraction of ownership of an NFT collection in Unicly.

So, in addition to providing fractionalized NFTs, Unicly also provides a route to trade and exchange these digital assets.

At the heart of the Unicly network is the native token, UNIC, which helps in all governance tasks within the platform.

NFTX

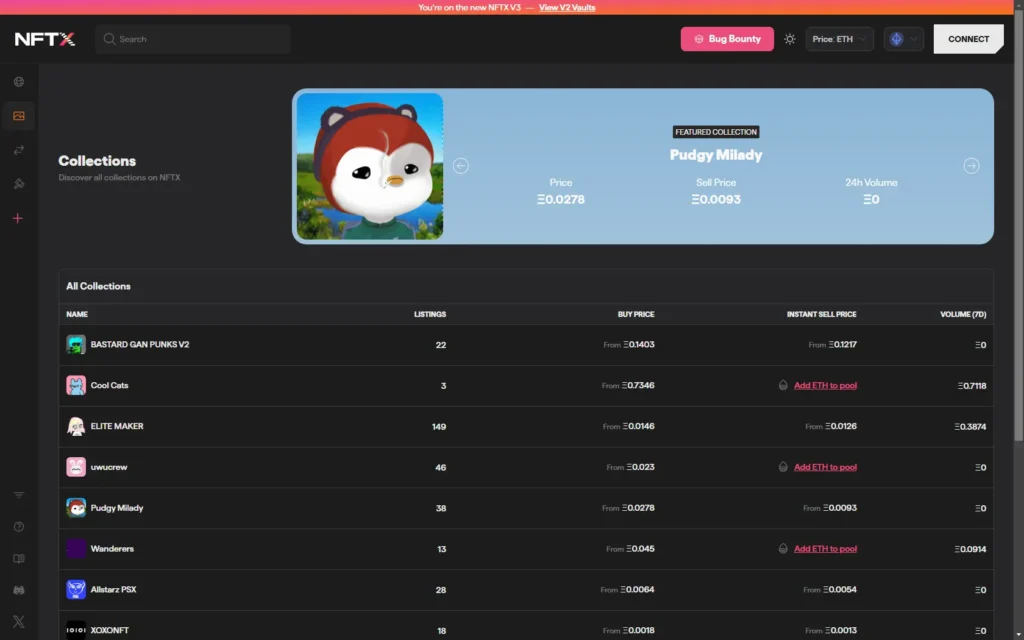

Finally, another fractional NFT trading platform, NFTX.

Defining itself as a platform for concentrated NFT liquidity provision, NFT brings a new Era of NFT liquidity and financialization. NFTX combines AMM, Ethereum-based vault fees, and premium fees to bolster your experience in the NFT space.

How to Buy Fractionalized NFT on NFTX

Several steps are involved in purchasing fractionalized Non-fungible tokens, especially on NFTX. Here is a short guide:

Connect Your Wallet

You begin by visiting the application page of NFTX, and connecting your wallet. To connect your wallet perfectly, click on the ‘CONNECT’ button in the top right corner of your screen.

When you click that, you will be able to work with a number of wallet options, including Metamask, Rainbow, Coinbase, and WalletConnect. Select the wallet you need and complete the linking.

Browse the Collections

Unlike some of the other fractional NFT projects above, NFTX.io offers a number of fractionalized NFTs. Find the perfect NFT or collection to buy, sell, or Swap.

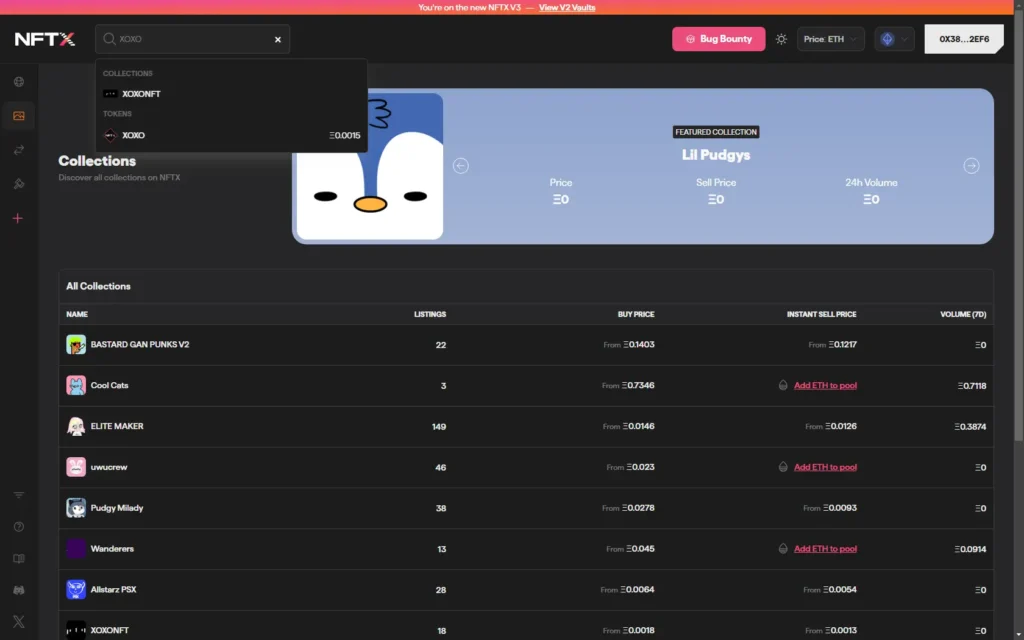

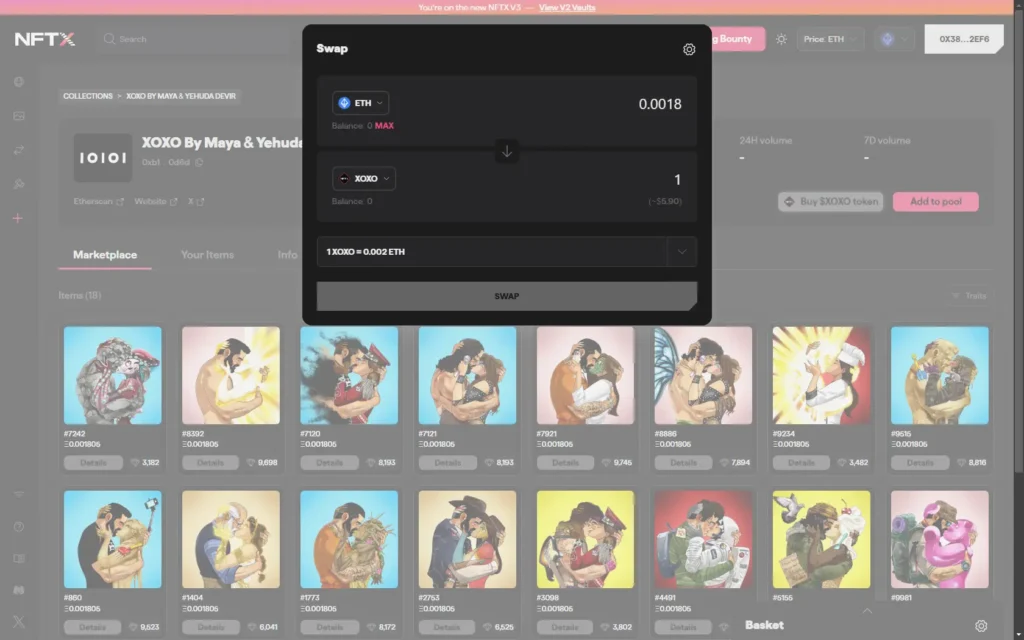

You can use the search button at the top right corner of the app to find the NFT collection you want to explore. For instance, we searched for XOXO.

Complete the Purchase

If you want to buy a fraction of the NFT, select the option to buy a token. In our example, we can purchase the $XOXO token directly related to the collection we aim to purchase.

Fill in the details of the amounts, and complete the purchase from your wallet.

The Benefits of Fractionalized NFTs

Fractionalized NFTs offer many benefits for every stakeholder in the world of digital assets. By dividing ownership of high-value NFTs into smaller, tradable assets, these NFTs open wide opportunities for the future.

- Enhanced NFT accessibility

- Increased liquidity

- Community ownership and engagement

- Opportunities to diversify

- Price discovery and market efficiency

- Easy monetization for creators

Conclusion

Fractionalization is a game changer in the world of NFTs. Millions of enthusiasts can purchase small fractions of NFTs by owning fungible tokens. The result is an inclusive ecosystem where every stakeholder has opportunities to thrive.

Frequently Asked Questions (FAQs)

What is a fractionalized NFT?

A fractionalized NFT is a digital asset divided into smaller, tradeable ownership shares. This allows multiple individuals to own a high-value NFT collectively, making it more accessible to a wider audience. The process involves tokenizing the NFT and distributing fractional tokens representing partial ownership.

What are the three types of NFTs?

The three main types of NFTs include art NFTs, which represent digital art; utility NFTs, which provide benefits like access to events or memberships; and gaming NFTs, which are used in video games for in-game assets like characters, weapons, or skins. These categories showcase the diverse applications of NFTs across industries.

Can one NFT have multiple owners?

Yes, through fractionalization, an NFT can have multiple owners. The NFT is tokenized and divided into smaller parts, allowing individuals to purchase fractions and collectively own the asset. Each fraction owner holds a proportional stake in the NFT.

How much does it cost to create 1 NFT?

The cost to create an NFT varies depending on the blockchain platform and network traffic. On Ethereum, minting fees (gas fees) can range from $10 to over $100 during high demand. Alternative blockchains like Solana or Polygon offer lower costs, sometimes under $1.